Strategies for Business Owners to Minimize Taxable Income

Strategies for Business Owners to Minimize Taxable Income

As a business owner, year-end can reveal a hefty tax bill. To reduce this, consider strategies like optimizing savings or consulting an accountant. Understanding tax laws and deductions can also lower your tax liability. This article offers practical tips to help protect more of your earnings from taxes, making your tax payments easier to manage.

Taxes are a crucial aspect for every entrepreneur and must be handled on time to avoid penalties and extra charges. As tax season approaches, some business owners rush to find ways to lower their taxable income to retain more money in their business.

Cutting back on your budget is not the best way to reduce taxes and may even increase your tax liability when you receive your financial report. Instead, there are legitimate strategies to reduce your taxable income. Here are some of the strategies you can use:

1. Invest in Municipal Bonds

Municipal bonds, issued by cities or states, offer tax-free interest income, which can help reduce your tax liability. Adding these bonds to your portfolio can be a smart way to manage your income more tax-efficiently. Consider how the tax-exempt interest from these bonds affects your overall income and financial plan, including other strategies like donations and tax credits.

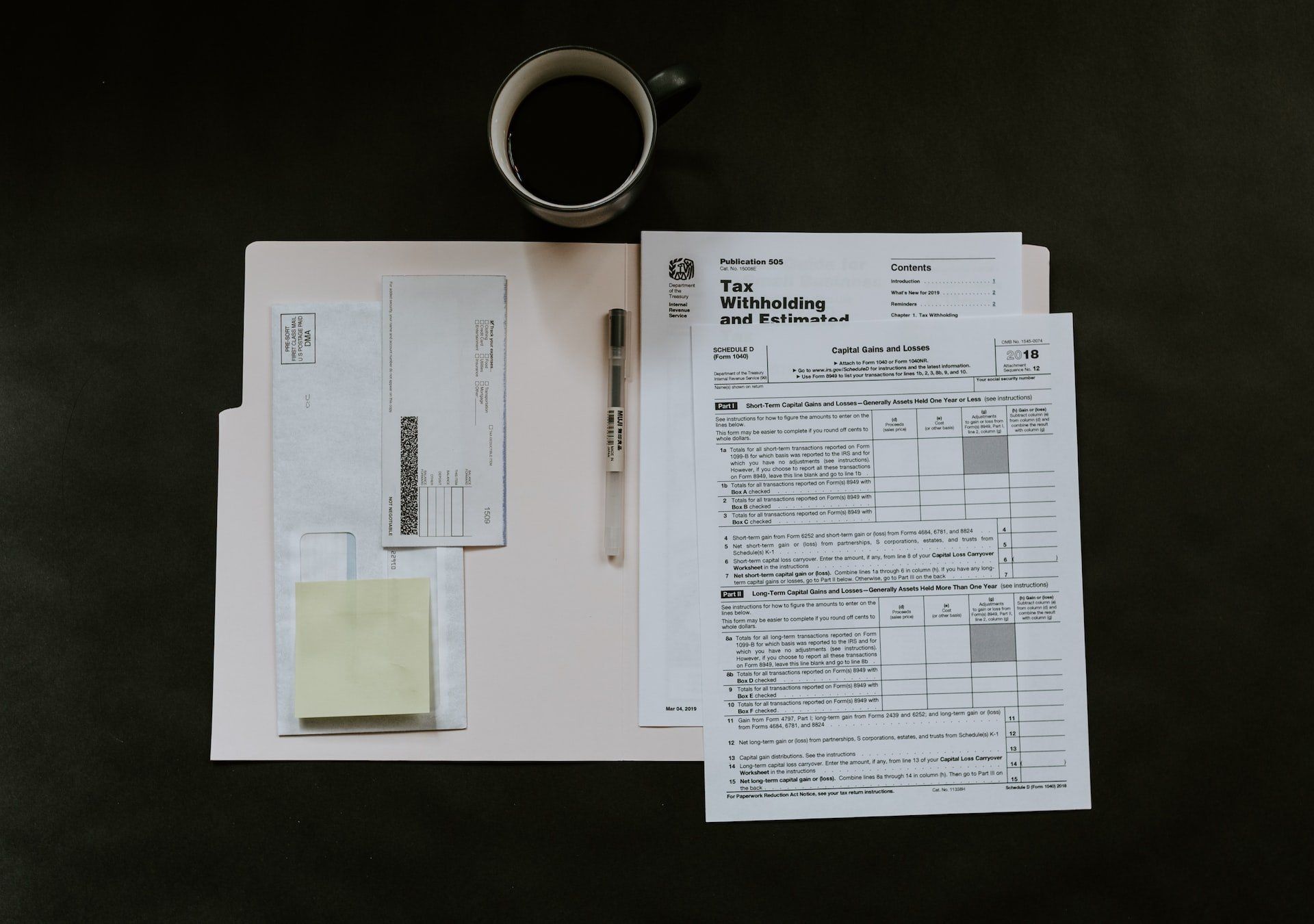

2. Aim for Long-Term Capital Gains

Focusing on long-term capital gains can be a smart move. By holding investments for over a year before selling, you benefit from lower tax rates compared to short-term gains. This approach can reduce your taxable income and may work well with deductions like student loan interest.

Keep in mind that long-term capital gains can affect other tax credits, such as the earned income tax credit. Balancing these gains with your overall tax situation can help you manage your tax bill effectively.

Consider how long-term gains fit into your broader financial picture, including expenses like health insurance premiums. Combining these strategies can help optimize your taxable income and strengthen your financial position.

3. Start a Business

Starting a business opens up new tax deduction opportunities. You can lower your taxable income by deducting legitimate business expenses like office supplies and travel. Keeping detailed records of these expenses helps maximize your deductions and reduce your tax bill.

Implementing a payroll system allows you to offer employee benefits like health insurance and IRAs, which also reduce your taxable income. These benefits can attract and retain employees while lowering your tax bracket.

Reinvesting in your business can qualify for tax deductions and set you up for favorable capital gains when you eventually sell. Additionally, using your business for personal investments, like a self-employed IRA, can lead to higher contribution limits and tax savings.

Starting a business offers new ways to manage your finances and reduce taxes. Next, explore how to maximize retirement accounts and employee benefits to further lower your taxable income.

4. Max Out Retirement Accounts and Employee Benefits

To lower your taxable income, focus on maximizing contributions to retirement accounts like a 401(k). These contributions are tax-deferred, potentially leading to a larger tax refund.

Also, consider using employee benefits strategically. For example, charitable donations and mortgage interest deductions on business properties can reduce your tax burden. These strategies not only boost your financial security but also provide immediate tax benefits.

5. Use a Health Savings Account (HSA)

A Health Savings Account (HSA) can help you save on taxes while covering health care costs. Contributions to an HSA are made with pre-tax money and grow tax-free if used for qualified medical expenses. This reduces your taxable income and offers a flexible financial strategy.

Unlike a fixed standard deduction, an HSA deduction increases with your contributions. HSAs also allow funds to roll over year after year, unlike flexible spending accounts.

Adding HSAs to your employee benefits package can also lower your business's payroll taxes and enhance your company's appeal to employees. This strategy not only benefits your finances but also promotes a healthy work environment.

Using an HSA is a smart way to reduce taxes and manage health expenses. Next, explore tax credits for further savings.

6. Claim Tax Credits

Claiming tax credits can help lower your tax bill. Credits like the Child Tax Credit and the Earned Income Tax Credit (EITC) directly reduce what you owe, potentially turning it into a refund.

Additionally, explore other credits relevant to your situation. For example, as a business owner, understand how Roth IRA contributions, wash sales, and filing status can impact your taxes. Also, check if life insurance premiums offer any tax benefits. Using these credits smartly can optimize your financial situation and reduce your tax burden.

How to Reduce Your Taxable Income?

Creating a Tax-Friendly Business Structure

To manage your cash flow and taxes effectively, it's crucial to design a business structure that minimizes your tax burden. Consulting an accountant can help you choose the best system for reducing taxes.

One effective option is the S-corporation, a pass-through entity that avoids double taxation. This structure allows you to deduct expenses like health insurance, home office costs, travel, meals, and entertainment from your taxes.

Saving Taxes with Reimbursement

The IRS allows generous reimbursement plans under accountable plans. Reimbursements for job-related travel expenses are excluded from employees' wages and not subject to withholding, as they are considered separate from salary.

For example, if employees travel for a conference, meet clients, or buy office supplies, you can reimburse these expenses tax-free.

Deferring Expenses and Balancing Taxes

To manage your taxes effectively, consider deferring some expenses and balancing your deductions. For example, if you plan to buy office equipment, delaying the purchase until the next tax year can reduce your current year's tax bill.

Additionally, balance your taxes by ensuring your deductions and expenses are well-aligned. This strategy can help optimize your tax situation across different years.

How Much Should I Put into My 401(k) to Reduce My Taxes?

As a business owner, contributing more to your 401(k) can lower your taxable income and build long-term wealth. Maximizing these contributions helps you reduce your current tax bill while preparing for retirement.

Consider your retirement goals and how much you can afford to invest without impacting your immediate finances. By contributing up to the allowable limit, you not only gain tax deductions but also protect your savings from inflation.

Maximizing your 401(k) contributions is a smart tax-saving strategy.

How Do High-Income Earners Reduce Taxes?

High-income earners can reduce their taxes through a few key strategies:

- Keep Detailed Records: Accurately track all deductions and file your tax form 1040 carefully to reduce your tax exposure.

- Invest Wisely: Instead of holding large amounts of cash, invest in tax-advantaged accounts to potentially lower your taxable income and grow your wealth.

- Document Business Transactions: Keep detailed records of all business-related communications and expenses to ensure easy verification and accurate deductions.

- Use Accounting Software: Utilize advanced software to manage your finances efficiently, identify tax-saving opportunities, and make informed decisions.

By applying these strategies, high-income earners can effectively minimize their tax liability.

Final Thoughts

Minimizing taxable income is key for business owners who want to grow their wealth. Investing in municipal bonds, focusing on long-term capital gains, and maximizing retirement contributions can lead to big tax savings. Setting up a business and using its structure to your advantage, along with taking all eligible deductions, helps lower tax liabilities. Making smart decisions about tax credits and savings, with professional guidance, is essential for effective tax planning and financial success.

If you're a business owner looking to reduce taxable income, you have several options: using deductions and credits, deferring payments, or investing in tax-advantaged accounts. Each option has specific rules, so it’s best to consult with a tax expert to find the right strategy for you. You can also rely on accounting services to handle tax planning while you focus on running your business.

For expert

accounting services in Loganville, GA, Acuff Financial Services is here to help you reduce your taxable income. Contact us today to learn more!

Our Locations

Contact Details

Phone: 770-554-8344

Email: info@acufffinancial.com

-

Loganville Office

Phone: 770-554-8344

Fax: 770-554-8338

Address: 1920 Highway 81 Southwest

Loganville, GA 30052

-

Watkinsville Office

Phone: 770-554-8344

Fax: 770-554-8338

Address: 3651 Mars Hill Rd Suite 700

Watkinsville, GA 30677

-

Winder Office

Phone: 770-867-2149

Address: 18 W Candler St. PO Box 686

Winder, GA 30680

Site Map

© Copyright 2025 | All Rights Reserved | Acuff Financial Services

Check the background of your financial professional on FINRA’s BrokerCheck .

Avantax affiliated financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state.

Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment advisory services offered through Avantax Advisory Services℠, Insurance services offered through an Avantax affiliated insurance agency.

The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management℠ does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business.

Content, links, and some material within this website may have been created by a third party [Faithworks Marketing] for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management℠ or its subsidiaries. Avantax Wealth Management℠ is not responsible for and does not control, adopt, or endorse any content contained on any third party website.