Things to Know about Dealing with Back Taxes

Dealing with Back Taxes

When it comes to taxes, there are a lot of terms that get thrown around. One of those terms is “back taxes.” But what exactly are back taxes?

In short, back taxes are taxes that you owe from a previous year (or years). This can happen for various reasons, but the most common reason is that you didn’t pay enough taxes during that year.

In today's article, let's take a closer look at back taxes and how you might be able to deal with them. Here's what you need to know:

How Does It Happen?

This can happen for many reasons. Maybe you underestimated your tax liability. Or maybe you had some changes in your life that resulted in you owing more taxes than you expected. Whatever the reason, if you end up owing back taxes, it’s essential to understand what that means and what your options are.

First, it’s essential to understand that back taxes are still your responsibility. Just because you didn’t pay them in the year they were due doesn’t mean you don’t owe them. If you owe state taxes, the IRS (and your state) will eventually come after you for the unpaid taxes.

How to Deal with Back Taxes?

No one likes dealing with taxes, especially when it comes to back taxes. But ignoring the problem will only make it worse. The sooner you take action, the better off you’ll be.

Here are some tips on how to deal with back taxes:

1. Don’t Ignore the Problem

The first step is to face the problem head-on. Don’t try to ignore it or hope it will go away. The sooner you take action, the better off you’ll be.

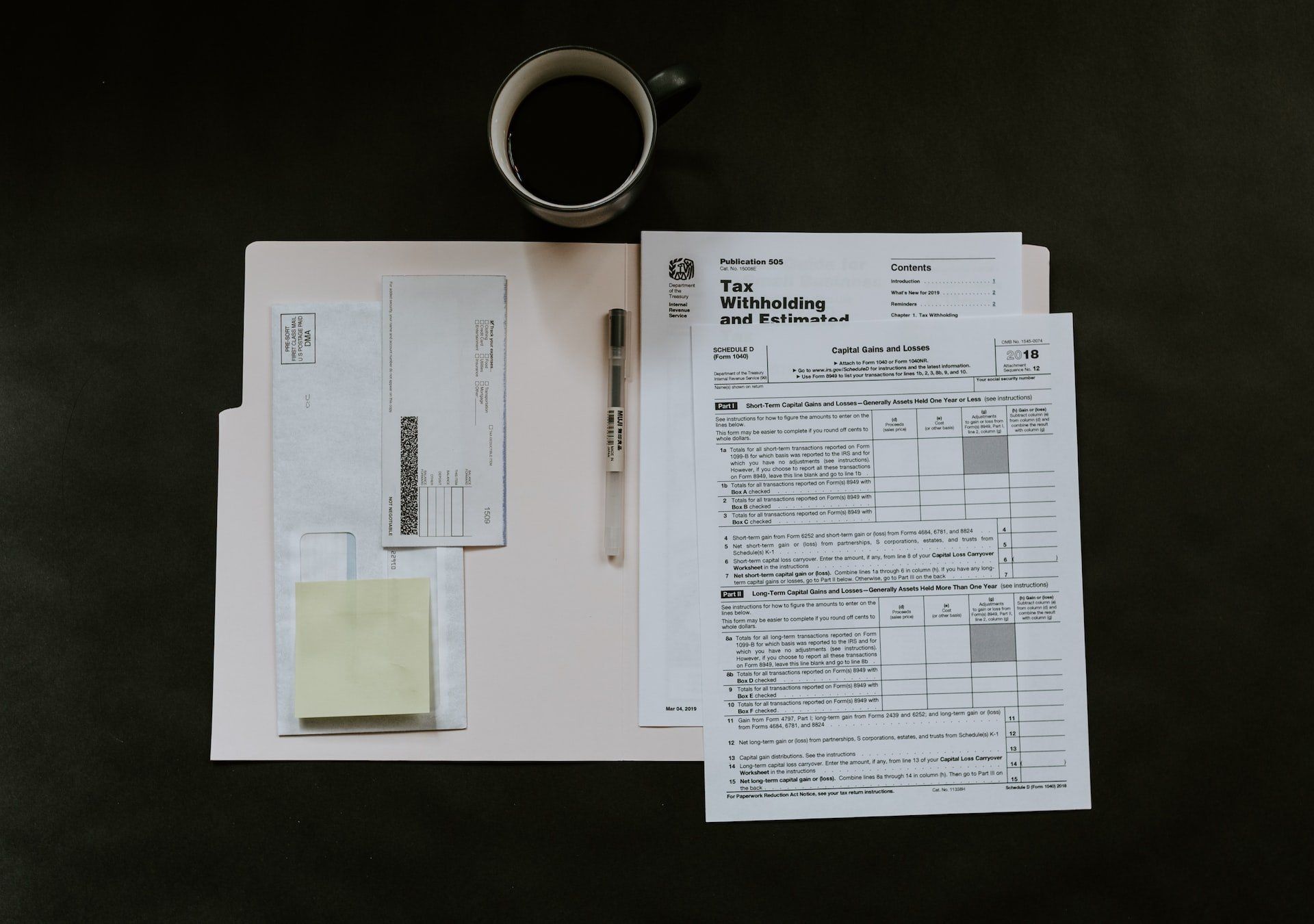

2. Find Out How Much You Owe

The next step is to find out how much you owe. You can do this by requesting a tax transcript from the IRS. This will show you all the taxes you owe for the past few years.

3. Create a Payment Plan

Once you know how much you owe, you can create a payment plan. The IRS offers several payment options, so you can choose the one that best fits your situation.

4. Pay Your Taxes

The most crucial step is to actually pay your taxes. This can be done by electronically filing your taxes, paying by check or money order, or paying with a credit or debit card.

5. Stay Current on Your Taxes

Once you’ve caught up on your back taxes, it’s essential to stay current on your taxes. This means filing your taxes on time every year and making sure you pay the total amount owed.

Dealing with back taxes can be daunting, but taking action and taking care of the problem is important. By following these tips, you can get your taxes under control and back on track.

The Bottom Line

It can be challenging if you're dealing with back taxes, but it's possible to get through it. You may need to seek professional help, but there are options available to you. You can negotiate with the IRS, set up a payment plan, or even try to get the debt forgiven. It's essential to explore your options and make the best decision for your unique situation.

If you are looking for reliable

accounting services in Loganville, GA & Watkinsville, we can help you. Acuff Financial Services is a comprehensive

accounting firm in Loganville, GA, committed to helping you pursue long-term financial success. Contact us today to learn more and get started!

Our Locations

Contact Details

Phone: 770-554-8344

Email: info@acufffinancial.com

-

Loganville Office

Phone: 770-554-8344

Fax: 770-554-8338

Address: 1920 Highway 81 Southwest

Loganville, GA 30052

-

Watkinsville Office

Phone: 770-554-8344

Fax: 770-554-8338

Address: 3651 Mars Hill Rd Suite 700

Watkinsville, GA 30677

-

Winder Office

Phone: 770-867-2149

Address: 18 W Candler St. PO Box 686

Winder, GA 30680

Site Map

© Copyright 2025 | All Rights Reserved | Acuff Financial Services

Check the background of your financial professional on FINRA’s BrokerCheck .

Avantax affiliated financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state.

Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment advisory services offered through Avantax Advisory Services℠, Insurance services offered through an Avantax affiliated insurance agency.

The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management℠ does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business.

Content, links, and some material within this website may have been created by a third party [Faithworks Marketing] for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management℠ or its subsidiaries. Avantax Wealth Management℠ is not responsible for and does not control, adopt, or endorse any content contained on any third party website.